Khalti Blog, 13 June 2018

The Financial Institutions in Nepal mainly comprises of the Central Bank which is better known as the Nepal Rastra Bank, the commercial banks, development banks, finance companies, and micro-credit development banks.

The Nepalese financial system development has a very recent history, starting just from the early twentieth century. In the year 1937 AD, Nepal Bank Limited was established as the first commercial bank in Nepal. The establishment of NBL was the epoch-making since it signified commencement of formal banking system in Nepal. In the year 1955, Nepal Rastra Bank Act was formulated for a better banking system and Nepal Rastra Bank(NRB) was established in 1956 as the Central Bank of Nepal. Subsequently, Rastriya Banijya Bank and Agriculture Development Bank (ADBL) were established in 1966 and 1968 respectively.

Till the 1980s, the banking sector was wholly owned by the government, with Agriculture Development Bank, Rastriya Banijya Bank, NBL and NRB being the pillars of financial institutions in Nepal.

The entry of other development banks, finance companies, micro-credit development banks, savings and credit cooperatives and Non-government organizations (NGOs) for limited banking transactions started after 1992 under three major acts namely Finance Company Act 1985, Company Act 1964 and Development Bank Act 1996. After introducing these acts, financial institutions in Nepal have seen a steady growth.

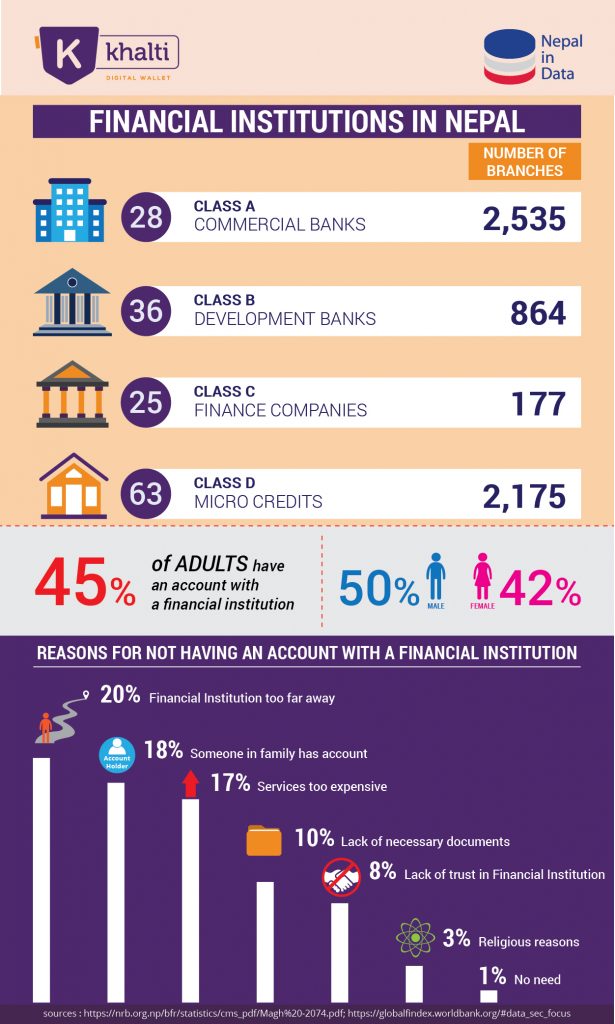

As of today, there are 28 commercial banks in Nepal, 36 development banks, 25 finance companies and 63 micro-credit development banks, with a total of 5700 branches across the nation. However, as per NRB’s statistics (Jan-Feb 2018), 45% of the adults are reported to have an account in a financial institution.

As of now, 510 out of the total of 753 local levels in Nepal have access to commercial banks. To promote banking habit, the government has already started distributing social security allowance and all other government to citizen payments through banks. This can be taken as an appreciable step by the government.

Furthermore, the government in its latest budget has announced to run a special campaign to open a bank accountof all Nepalis within a year. It is expected to further promote financial inclusion, mobile banking and online payment habit among citizens.

Source: https://blog.khalti.com/banking/status-of-financial-institutions-in-nepal/